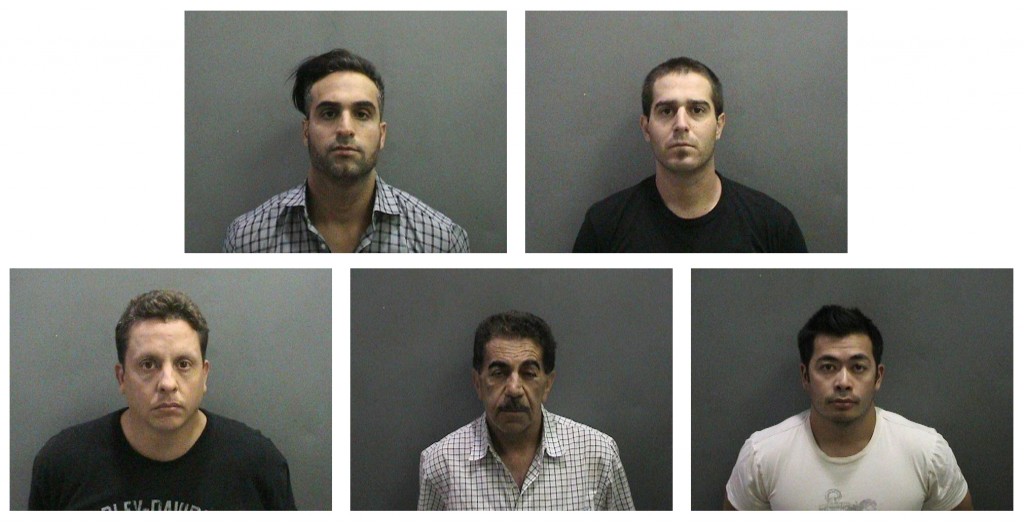

— Photos courtesy Newport Beach Police Department

In the largest loan modification scheme ever prosecuted in the country, seven defendants were indicted this week for defrauding $13.5 million from more than 3,500 victims, according to authorities.

A statement was released jointly by the Orange County District Attorney and Newport Beach Police Department on Thursday.

NBPD began investigating the case in August 2012 after victims reported the scam. Police arrested five of the defendants on May 14. The remaining two are fugitives and have warrants out for their arrest.

Maziar Bordbar, 31, of Irvine, Nathaniel Ferrer, 26, of Orange, Pamela Gressier, 54, of Huntington Beach, Saeid Yarandi, 31, of Irvine, Roberto Duran, 41, of Montebello, Masood Taghizadeh, 64, of Laguna Niguel, and Joel Valdellon, 31, of Dana Point, have all been charged.

Charges include conspiracy to commit a crime, conspiracy to defraud another of property, grand theft, theft from an elder, money laundering, unlawful monetary transaction structuring, filing false tax returns, willful failure to file or make a fraudulent tax return,

There are also many sentencing enhancements, which include committing an aggravated white collar crime over $100,000 and another for over $500,000, property damage or loss over $65,000, property loss over $200,000, property damage over $1.3 million, money laundering exceeding $50,000 and three more for exceeding $150,000, $1 million and $2.5 million, and committing a theft exceeding $100,000.

Between Nov. 16, 2010, and June 6, 2011, Bordbar and Yarandi are accused of incorporating Consult Marketing Group, Inc. and Secured Processing, Inc. Between June 24, 2011, and Aug. 31, 2012, Gressier is accused of filing a fictitious business name statement doing business as Prudential Law Group, Remedy Law, and Remedy Center Law.

At the time of the crime, Gressier was a licensed attorney and practicing law in California.

Bordbar, Yarandi, Ferrer, and Gressier are accused of operating Prudential Law Group which later became known as Prudent Law Group (Prudent Law). Bordbar, Yarandi, Ferrer, and Gressier are accused of changing the company name from Prudent Law to Remedy Center Law and various other similar names, and establishing a website for Prudent Law and Remedy Law to advertise loan modification services.

They reportedly sent mailings to thousands of homeowners advertising loan modification services and hired telemarketers to work as salespersons for homeowners calling in response to the advertisements, according to the statement.

The defendants falsely misrepresented to customers that they qualify for a loan modification, when the defendants had no ability or authority to represent the victims on behalf of the lender, according to the DA statement. They charged fees upfront for the services.

They allegedly laundered the money they received by transferring the funds between bank accounts within a seven or 30-day period.

In March 2012, Bordbar is accused of making a series of transactions under $10,000 through a bank to avoid having the bank file reports of the transaction. A financial institution is required to file a report with the Department of Justice on cash transactions that exceed $10,000.

If convicted, Bordbar faces a maximum sentence of 52 years in state prison. Ferrer faces a maximum of 27 years and four months. Gressier and Yarandi face 48 years and eight months. And Duran, Taghizadeh and Valdellon, face a maximum sentence of 14 years in state prison.

Bordbar and Ferrer are being held on $9.8 million bail, Duran and Valdellon are being held on $5 million and Taghizadeh on $3.5 million. Gressier and Yarandi are fugitives and have warrants out for their arrest.

Along with NBPD and OCDA Bureau of Investigation, the USSS, Franchise Tax Board, State Bar of California, FBI, Huntington Beach Police Department, Irvine Police Department, and the California Bureau of Real Estate investigated or assisted on the case.

For more information, visit the media center at orangecountyda.com and select Prudent/Remedy Law Loan Modification case

Greed, root of all evil !

They deserve it. I hope the ring leader gets the maximum sentence. That Bordbar used different aliases in taking people’s money and homes when they’re facing a hardship is the lowest thing you can do..He was a pro at it.

If these people are granted bail, it should be cash bail only….that means they would have to place the full amount down to the courts, not pay 10% to some bail bondsman.

That way, if they are convicted, some of that money can go to the victims of these dastardly deeds; and if they are innocent (yeah, right!), the funds are returned to them.

If they pay a bondsman—and then are convicted, that premium is money that could have gone to compensate victims…

Or, if they only pay 10% down, that should be still be paid directly to the courts…

Actually, the OCDA press release quotes the following…

“The defendants must prove bail money is from a legal and legitimate source before posting bond.”

I’m pretty sure they are out of luck there…

They are out of luck because their bail is 13 million dollars, more than the serial killer that’s on trial. Either the DA could care less about serial killers or…they are incompetent. I’m guessing incompetent.

They are all out

“Maziar Bordbar made bail,what a joke!! and what a looser!!

If they get bail. I’m buying a plane ticket!

They took $5K from us during the summer of 2014 till last payment was September…. Know my home is back in foreclosure , I was wondering why the last 3+ weeks of call and messages I left , nobody returned any calls or emails…. Totally disgusted !

None of them will post bail. 10% of any of these amounts is over $500K remember this premium is Non Refundable ….. I can’t believe Rob Duran was involved in this , you would think he would of been trying to walk a straight line after serving 3 years and barely being released 2 years ago… I like Rob but I do not feel sorry for him . He is a idiot! Sorry Rob I don’t see you talking your way out of this one !

It is ridiculous that people will believe that these people are guilty just because they are being accused. Of course the article writer never mentions the fact that the DA refuses to turn over discovery that they have had for six months so these people can defend themselves. The real injustice is through the actions of the DAs office.

There are thousands of people who were ripped off in this case. This isn’t really a who-done-it. As far as bail is concerned, the type of crime is only one factor. The are several factors to flight risk that the Judge looks at when determining bail. The prosecutor is probably dancing in her office when thinking about the chances for conviction.

Mazi, now you know how I feel. Welcome to the big house bro.

Only the Truth will prevail…Shame on all of you if found guilty, while all of us are out here busting are butts working Real Jobs, you will all get what you deserve and so will big bubba in your cell.

Doing life right should try to do life right…I don’t remember you being appointed judge and jury. It is disgusting that people make assumptions based only on information they have read in a local throw-away newspaper.

Christina, this news was also printed in the Times, Register, OC Weekly and more. You seem to want badly for these criminals to be innocent. I work in the building on Campus Dr in Newport that their scams were run out of. After years of defrauding people- who were already facing tough times- it was a victorious day when the DA, FBI, PD, CSI, even the Bar Assn raided the offices. Google any of their business aliases to read some of the stories online form the people they’ve hurt.

Laura, I do not “want” them to be innocent. I believe that they are innocent. Just like you believe, without any facts or any knowledge whatsoever, that they are guilty. Out of all the modifications that they did, 5 loans did not get modified. They didn’t get modified because the borrower’s refused the bank’s offer. Laura, that is not fraud. It is really disturbing that because you park your car next to someone you assume you know facts about them to the extent that you post comments about their guilt or innocence.

I’ve spoken face to face with numerous people that these scam artists defrauded, both of their own employees that they did not pay and the victims that were sent bogus offers through the mail. They have been here looking for these criminals who were changing company names every few months to hide. I’m guessing you know one of them personally that has made up those numbers for you. Maybe you should check with NBPD or just look up info on any of their companies: Home Remedy Center, aka Novation Law, aka Secured Processing Inc., aka National Remedy Center.

Laura, information about this case, like other criminal matters being prosecuted are not public record. The police nor any other public agency are going to provide information concerning evidence to the public. You would have no reason to speak to former customers or former employees. You sound like a disgruntled employee hiding behind an alias. Whoever you really are, whatever your motive really is, it is not honest or unbiased. You know only a little about this case and what you do know is untrue. In America, we can say whatever we want without repercussion. We can also call a spade a spade. It’s wrong to go to the public and try to discredit people when you don’t know the facts. I but if they didn’t pay you, they had a good reason. I wonder if you were dishonest at work too.

These guys got Greedy and then just kept changing the company name, even after the intial raid the same manger Mike Zadeh transferred to another office all related to the same company using a fake name, they have been Law offices of Angela Mueller, Pristine Mortgage and most recently Univesal Consumer Law Group under another silent partner/owner “Mike Nejad” (thats the name he uses)just heard they recently closed that office at the Colton Plaza in Irvine also to run and hide.

Any updates on this case?

They stole $5,000.00 from us ,, haven’t heard from them since beginning of September, never retired any calls, messages emails….. Now for sure I’m screwd, for paying these idiots to help save my house !!!

I2 am a victim of this fraudulent scam. I am not getting any help in reference to the restitution I have since sold the home at a great loss but not trusting any other company or bank or attorney I am a disabled senior citizen the money I provided to them came from my retirement account and I need my money now thank you Edith Boyle